If it feels like the market is stuck on a loop, it kind of is. The July 2025 Colorado housing market continues a pattern we’ve seen for months: more inventory, hesitant buyers, and rates that barely budge.

The latest numbers (based on DMAR’s Denver area housing market data through June) reinforce the same familiar storyline: supply is building, sales are soft, prices are holding, and mortgage rates remain the recurring guest star nobody asked for.

July 2025 Colorado Housing Market: Inventory Up, Audience Down

Pending sales were up 5.74% from May but down slightly YoY (–1.62%). Closed sales slipped again (–1.65% MoM and –9.59% YoY). So the funnel is filling, but the flow isn’t strong.

In other words, we’re watching the same market shift that started months ago: supply is outpacing demand, but not dramatically enough to challenge affordability in the face of interest rates.

Buyers hoping for a major price drop this summer may be disappointed. Prices are still climbing… but slowly.

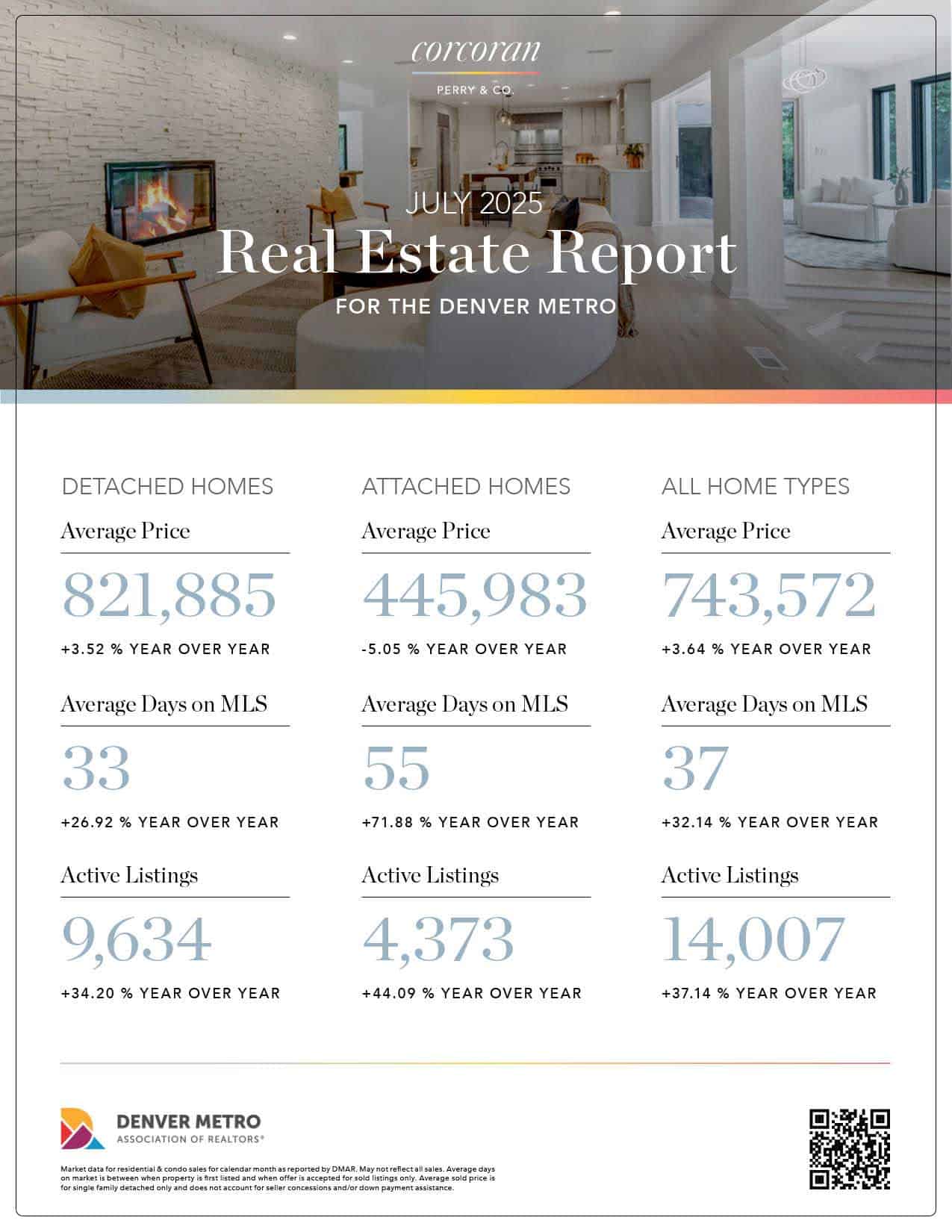

The average closed price rose 3.64% MoM and 3.4% YoY. Median prices were a little flatter, up 1.7% both MoM and YoY.

This isn’t a market correction. It’s a soft deceleration. Builders are offering more incentives than ever (37% are cutting prices, per the NAHB), and sellers who overpriced are now playing catch-up. But demand is still high enough — especially in well-located neighborhoods — to keep prices from slipping much.

Days on Market:

The speed of the market continues to return to something less speedy.

- Average days in MLS rose 32.14% MoM and 12.12% YoY

- Median days in MLS were up 50% MoM and 38.46% YoY

That sounds dramatic, but this is more a rebalancing than a red flag. Buyers are taking their time, and sellers who miss the mark on pricing are getting passed over.

The close-price-to-list-price ratio dropped to 99.2%, down 0.55% MoM and 0.33% YoY. Buyers are negotiating. And sellers who expected bidding wars are adjusting to a quieter room.

Rates & Incentives:

If you’re waiting for rates to drop into the 5s, you may want to get comfortable in the 6s. Most forecasts still call for two Fed rate cuts in 2025, but the impact on mortgage rates will likely be modest. High 6s are still the norm.

Meanwhile, builders are trying to move inventory with record incentives. And some move-up sellers (those who’ve been on the sidelines since 2020) are finally dipping a toe back in.

But affordability is still the elephant in the room. Tariffs on construction materials, higher insurance costs, and stagnant wages are all keeping things tight… especially for first-time buyers.

The “Back 9” of 2025:

The back half of 2025 looks like more of the same. This market isn’t collapsing. But it isn’t sprinting either. It’s jogging… slowly.

If you’re a seller, this isn’t the time for wishful pricing. Today’s buyers are sharp, deliberate, and not interested in overpaying for underprepared homes.

And if you’re a buyer, don’t expect a miracle drop in rates or a sudden inventory spike. But do expect more room to negotiate, more days on market, and less competition.

The July 2025 Colorado housing market is steady, slow, and unexciting… perfect for those who would like to jump in with both feet and test the waters!